Table of Contents

- What is Basel I, Really?

- Why Basel I Came to Be

- The Main Ideas of Basel I

- How Basel I Changed Things

- Basel I and the Idea of Risk

- Its Lasting Mark

- Common Questions About Basel I

What is Basel I, Really?

So, what exactly is Basel I? Well, it's a set of international banking rules. These rules were put together by a group called the Basel Committee on Banking Supervision. This committee is made up of central bankers and bank supervisors from many different countries. They meet in Basel, Switzerland, which is where the name comes from, you know.

The main goal of Basel I was to make sure banks around the world had enough capital. Capital, in this case, means their own money, the funds they have to fall back on. This was a way to make banks more secure and less likely to fail. It was, in a way, a very simple idea but with big effects.

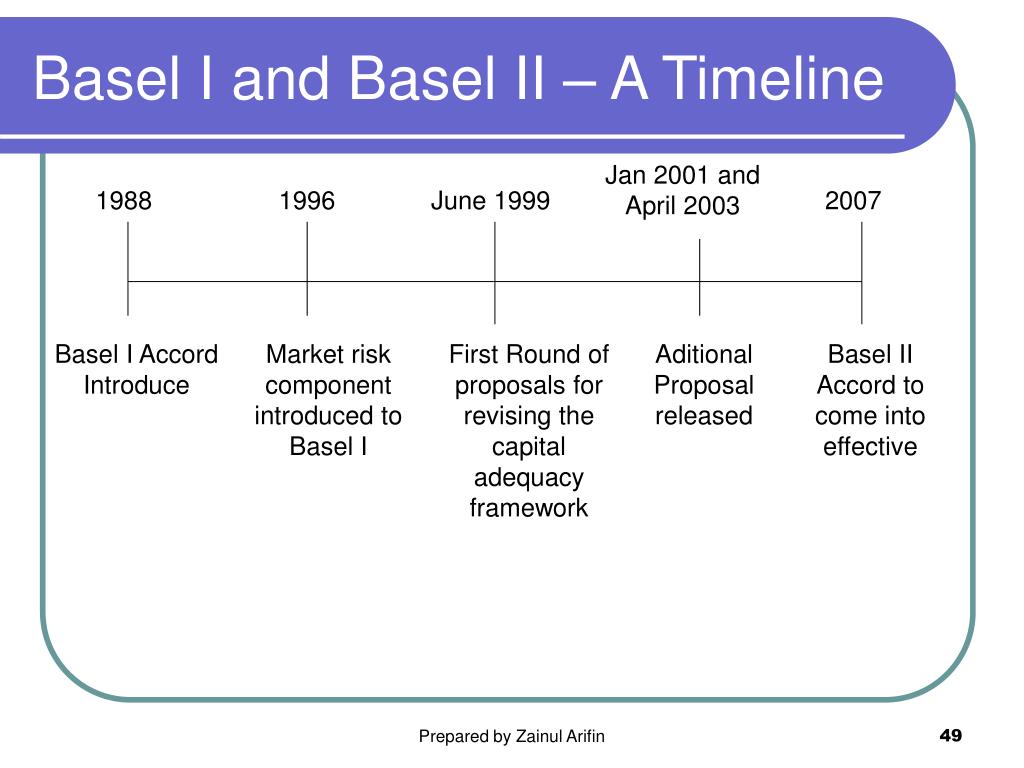

It was introduced in 1988, which feels like a long time ago, but its impact is still felt. This agreement set a basic standard for banks everywhere. It was, quite honestly, a pioneering step in how banks operate globally. It just gave a common way to look at how much money banks should hold.

Why Basel I Came to Be

The reason Basel I came about is actually pretty important to think about. In the 1980s, there were some worries about the financial system. Banks were growing, and some felt they weren't holding enough of their own money. There was a concern that a bank failing in one country could cause problems in other countries, too, you see.

People were a bit concerned about something called "capital adequacy." This just means having enough funds. If banks didn't have enough, a small problem could turn into a much bigger one. So, there was a real need for a common set of rules that everyone could agree on. It was about making the whole system safer for everyone involved.

Also, banks in different countries had different rules. This made it hard to compete fairly, and it made it tricky to keep an eye on things globally. Basel I aimed to level the playing field, in a sense. It helped create a more standardized way of doing business across borders, which was very helpful.

The Main Ideas of Basel I

Basel I had a few key ideas, and they were pretty straightforward. The most important one was setting a minimum capital requirement. This meant banks had to hold a certain amount of their own money compared to their risky assets. It was like saying, "For every dollar of risky stuff you have, you need to keep this much safe money on hand," so.

Specifically, Basel I said that banks needed to hold capital equal to at least 8% of their "risk-weighted assets." Now, "risk-weighted assets" sounds a bit fancy, doesn't it? But it just means that different things a bank invests in or lends money for have different levels of risk. For example, lending to a government might be seen as less risky than lending to a brand-new, small company.

To figure this out, Basel I created categories for assets based on their riskiness. These categories had different "weights" or percentages. For instance, cash or government bonds might have a 0% risk weight, meaning they needed no capital held against them. Loans to companies might have a 100% risk weight, meaning you needed to hold 8% capital against the full loan amount. It was a way of structuring the information, a bit like organizing data in a coding matrix, where you assign values based on certain criteria, you know, just like when you're working with data in computer science questions and answers.

This was a very basic way to measure risk, and it was the first step. It really simplified things, allowing for easier comparisons between banks. This simple system helped supervisors get a clearer picture of how much risk banks were actually taking on. It was a way to normalize the way banks reported their financial health, very much like how you might normalize data in a statistics and probability question to make comparisons fair.

How Basel I Changed Things

Basel I brought a new way of thinking to the banking world. Before it, there wasn't a widely accepted global standard for capital. Banks could operate with very different levels of safety. This agreement really pushed banks to be more careful about how they managed their money, and their loans, too.

It also encouraged banks to think about the risks they were taking. If an asset was deemed riskier, the bank had to put more capital aside. This made banks a bit more cautious about their choices. It was, in a way, a nudge towards safer practices across the board. It truly changed how banks viewed their balance sheets.

This framework also made it easier for countries to talk about banking rules. It gave everyone a common language and a common starting point. This helped with cooperation and made the global financial system a little more connected and, in some respects, more stable. It's a bit like how a linking matrix helps you see which sites connect to which, showing the structure of relationships.

Basel I and the Idea of Risk

The concept of risk is pretty central to Basel I. It was all about making sure banks had enough of a cushion for unexpected losses. If a loan went bad, or an investment lost money, the bank's own capital would absorb that loss. This kept the bank from failing, which is very important for everyone.

However, Basel I's way of looking at risk was, perhaps, a bit simple. It mostly focused on credit risk, which is the risk that a borrower won't pay back a loan. It didn't really account for other kinds of risks, like market risk (where investments lose value due to market changes) or operational risk (problems from a bank's daily operations). This was, admittedly, a limitation.

Even with its simpler approach, it was a huge step forward. It got banks and regulators thinking seriously about risk in a standardized way. This foundational step paved the way for more complex and detailed risk management frameworks later on. It truly set the stage for how we think about bank safety today.

Its Lasting Mark

Even though Basel I was later updated by Basel II and then Basel III, its influence is still very clear. It established the very idea of international capital standards for banks. This was a concept that had not been so widely adopted before, you know. It truly changed the game for how banks operate globally.

It taught us that having a common framework for bank capital is pretty vital for financial stability. It showed that when countries work together on these kinds of rules, the whole system benefits. This initial agreement was a foundational piece, a bit like the core design of a compact keyboard that saves space but still does everything you need. It was small in scope compared to later versions, but very effective.

Today, discussions about bank regulation still build on the principles first laid out in Basel I. It really set the tone for how we approach keeping our financial system safe and sound. It's a testament to its basic strength that its ideas continue to shape things, even as rules get more detailed and specific. It's like the initial coding matrix that gets refined over time but remains the basis.

Common Questions About Basel I

Here are some things people often ask about Basel I, just to clear things up a bit:

What was the main purpose of Basel I?

The main purpose of Basel I was to make sure banks around the world held enough of their own money. This was to protect them from losses and keep the global financial system steady. It set a basic rule for how much capital banks needed to have, you know, compared to their risky assets.

How did Basel I measure risk?

Basel I measured risk by categorizing a bank's assets based on how risky they seemed. For example, cash was seen as very safe, while some loans were seen as more risky. Each category was given a "risk weight," and banks had to hold capital against these weighted assets. It was a pretty simple way to look at risk, but it was a start, anyway.

Is Basel I still used today?

While Basel I itself is not the primary set of rules banks follow today, its core ideas are still very much alive. It was updated by Basel II and then Basel III, which are more detailed and complex. However, Basel I laid the very groundwork for all the bank capital rules that came after it. It's like the first version of a really important software, you know, still foundational.

Understanding Basel I helps us appreciate the journey of financial regulation. It shows how a simple, yet powerful, idea can grow and adapt over time to meet new challenges. It's about building trust and keeping things steady for everyone. You can learn more about the Basel Accords and their history on the Bank for International Settlements website, if you like. Also, learn more about financial stability on our site, and link to this page about banking rules.

Detail Author:

- Name : Marisa Klein

- Username : hassie.treutel

- Email : viviane31@gmail.com

- Birthdate : 1979-05-22

- Address : 7924 Tremaine Causeway Olgahaven, AK 48960

- Phone : (847) 667-4609

- Company : Altenwerth, Mosciski and Hoppe

- Job : Court Reporter

- Bio : Tempore dolores animi beatae dolores occaecati. Velit assumenda aspernatur temporibus praesentium. Non voluptatem iure facere laudantium aliquid.

Socials

twitter:

- url : https://twitter.com/goldnerj

- username : goldnerj

- bio : Qui quae nostrum sit a id enim. Similique voluptatem quasi qui at explicabo similique. Veritatis dolore ratione cum et id exercitationem.

- followers : 3314

- following : 1425

instagram:

- url : https://instagram.com/goldnerj

- username : goldnerj

- bio : Perspiciatis vel omnis rerum est itaque eaque. Aut illum dolores doloremque praesentium et est.

- followers : 150

- following : 991

tiktok:

- url : https://tiktok.com/@goldner2022

- username : goldner2022

- bio : Similique dignissimos ut sint qui quisquam nihil culpa.

- followers : 2536

- following : 2998

linkedin:

- url : https://linkedin.com/in/jeffery.goldner

- username : jeffery.goldner

- bio : Atque aut a ea voluptatibus consequatur qui.

- followers : 4510

- following : 769

facebook:

- url : https://facebook.com/jeffery_official

- username : jeffery_official

- bio : Hic asperiores quam ut ut vitae molestias.

- followers : 6417

- following : 2887