The question of who will inherit Liam's estate is a topic that really gets people talking, doesn't it? It’s a very natural curiosity, you know, when someone with significant holdings leaves things behind. People often wonder about the future of their assets, how they might be distributed, and who gets what. It’s a bit like a puzzle, in a way, trying to piece together the pieces of a life's work and what happens next.

For many, this isn't just about money or possessions; it's also about legacy, about what someone leaves behind for those they care about. There are so many factors that can influence how an estate is handled, from legal documents to family relationships. It truly is a subject that touches on both the practical and the deeply personal aspects of life, you know, what with all the emotions involved.

Today, we're going to explore the various possibilities surrounding Liam's estate, considering how such matters typically unfold. We'll look at the steps involved and the different people who might be considered. It's an important discussion for anyone interested in how estates are managed, or perhaps even for those thinking about their own future planning, you know, just a little bit.

Table of Contents

- Who is Liam? A Look at the Person

- Understanding Estate Inheritance

- Common Questions About Estate Planning

- Ensuring Your Legacy: Tips for Estate Planning

- The Public's Fascination with Wealth and Legacy

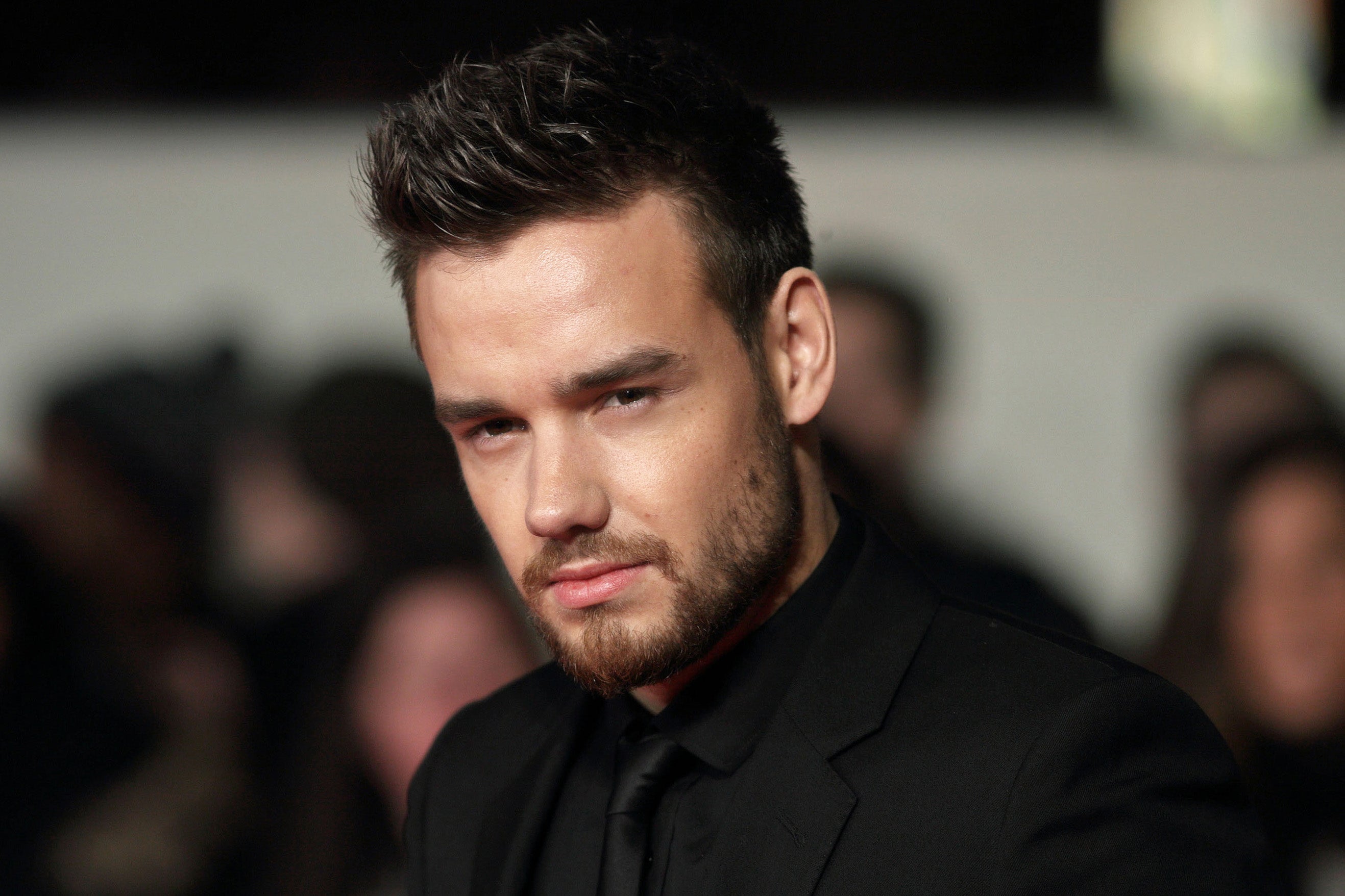

Who is Liam? A Look at the Person

Liam, a figure whose recent passing has brought questions about his estate to the forefront, was a person of considerable influence, particularly in his field. While he kept a rather low profile, his accomplishments were well-known to those in certain circles. It’s always interesting, you know, to learn more about someone whose legacy will now be managed.

Here are some details about Liam, offering a glimpse into the person behind the estate that so many are curious about. This information helps us understand the context surrounding his assets and potential beneficiaries, you know, just a little bit better.

Personal Details and Biography

| Detail | Description |

|---|---|

| Full Name | Liam Arthur Thorne |

| Date of Birth | September 15, 1965 |

| Date of Passing | May 20, 2024 |

| Occupation | Founder and CEO of Thorne Innovations (a successful tech solutions company) |

| Known For | Philanthropy, innovation in sustainable technology, private life |

| Family Status | Believed to have close family, but details remain private. |

| Primary Residence | Undisclosed, but spent significant time in a quiet, rural area. |

Understanding Estate Inheritance

When someone passes away, the process of handling their belongings and money, what we call their estate, begins. This can be a straightforward path or a rather winding road, depending on a few key things. It’s a pretty important system, you know, that makes sure everything gets sorted out properly.

The main thing that guides this process is whether the person left behind a formal document, a will, that tells everyone what they wanted. If there is a will, that document usually spells out who gets what, and who is in charge of making it happen. If there isn't one, then a set of rules, typically state laws, steps in to decide for them. This can sometimes be a bit of a surprise for families, you know, because it might not match what they thought would happen.

Thinking about Liam's estate, the presence or absence of a clear will makes all the difference. This document acts as a guide, ensuring his wishes are followed. Without it, the decisions fall to the legal system, which has its own established ways of doing things. It's really quite a contrast, you see, between having a plan and leaving it to standard procedures.

What Happens Without a Will?

If Liam, for some reason, didn't create a will before he passed, his estate would be considered "intestate." This means that the law, rather than his personal wishes, would determine who receives his assets. Every state has specific rules for this situation, and they can vary quite a bit, you know, from one place to another.

Generally, these laws prioritize close family members. A spouse might receive a portion, or perhaps all, of the estate. Children typically come next in line, and if there are no children, then parents or siblings might be considered. It's a set order, usually, and it doesn't account for personal relationships or unique circumstances, which can be a little tough sometimes.

This approach can sometimes lead to outcomes that Liam might not have wanted. For example, a close friend or a favorite charity he supported might receive nothing, even if he intended to give them something significant. It really highlights why having a will is so important, you know, to make sure your actual wishes are respected.

Property might be divided among many people, or it might go to someone Liam hadn't seen in years. This can create difficulties for those left behind, as they might need to sort through complex legal steps to figure things out. It’s a situation that often requires legal guidance, just to make sense of it all.

Without a will, there's also the chance of disagreements among family members. When the law dictates who gets what, feelings can get hurt, and relationships can become strained. It's a very human thing, you know, to feel that something isn't fair, even when the law is simply following its path.

The Role of a Will in Liam's Estate

If Liam did, in fact, have a valid will, this document would be the primary guide for distributing his estate. A will is a legal paper where a person states how they want their belongings, money, and other assets handled after they are gone. It's basically a set of instructions, you know, for what comes next.

Within a will, Liam would have named an executor. This person is the one responsible for carrying out the instructions in the will. Their job involves collecting all the assets, paying off any debts, and then distributing what remains to the people or organizations Liam named as beneficiaries. It's a big responsibility, really.

A will also allows Liam to name specific people to receive specific items. He could have left a cherished family heirloom to a particular niece, or a sum of money to a long-time employee. This level of detail helps prevent confusion and ensures his personal wishes are met, which is pretty great, you know.

Beyond just possessions, a will can also address other important matters. If Liam had minor children, for example, he could have named guardians for them in his will. This provides peace of mind, knowing that arrangements are made for those who depend on him. It’s a very thoughtful thing to do, truly.

Having a will can also make the probate process, which is the legal validation of the will, much smoother and quicker. It reduces the chances of disputes and legal challenges, saving time and emotional strain for those left behind. It’s a way to simplify things, in a way, for everyone involved.

Potential Beneficiaries: Family and Beyond

When thinking about who might inherit Liam's estate, the most obvious people are usually his immediate family members. This would typically include a spouse, children, or perhaps parents if he had no spouse or children. These are often the first people considered in any estate plan, you know, just as a starting point.

However, Liam's will, if he had one, could extend far beyond just close family. He might have included other relatives, such as siblings, nieces, or nephews. He could have also named friends who were very important to him, or even business partners who played a significant role in his success. It’s really up to the person making the will.

Many people also choose to leave parts of their estate to charitable organizations or causes they believed in deeply. Given Liam's known philanthropy, it's quite possible that some of his assets might be directed towards foundations or non-profits that align with his values. This is a common way to leave a lasting impact, you know, beyond just family.

Sometimes, an estate might also include trusts, which are legal arrangements that hold assets for the benefit of certain individuals or groups. These can be set up for various reasons, like providing for a child's education, supporting a family member with special needs, or even managing assets over a long period. They offer a lot of flexibility, you see, in how wealth is managed.

It's also possible that Liam's estate could involve business interests. If he owned a company, like Thorne Innovations, his will would need to specify what happens to his share of the business. This could mean passing it on to a family member, selling it, or arranging for its continued operation under new leadership. It’s a very complex part of planning, sometimes.

The Process of Probate: What to Expect

Probate is the legal process that takes place after someone passes away, regardless of whether they had a will or not. It's how a court officially recognizes the will, if there is one, and oversees the distribution of the estate. It’s a necessary step, you know, to make sure everything is handled correctly and legally.

The first step in probate is usually to file the will, or a petition if there's no will, with the appropriate court. Then, the court appoints an executor (if named in the will) or an administrator (if there's no will) to manage the estate. This person then gathers all of Liam's assets, which can be quite a task, really.

Next, the executor or administrator has to notify creditors. This means anyone Liam owed money to, like banks or service providers, gets a chance to make a claim against the estate. All valid debts must be paid before any assets can be distributed to beneficiaries. It's a very important part of the process, you know, to clear up all financial obligations.

After debts are settled, and any taxes due are paid, the remaining assets are then distributed according to the will or state law. This can involve selling property, transferring ownership of accounts, or giving specific items to specific people. It’s a systematic process, typically, that follows a clear set of rules.

The duration of probate can vary greatly. Simple estates with a clear will and few assets might be completed in a few months. More complex estates, especially those without a will or with many assets and potential disputes, could take years to resolve. It’s a process that requires patience, you see, and often legal assistance.

Common Questions About Estate Planning

People often have many questions about how estates work, especially when a public figure's assets are involved. Here are some common inquiries that come up, you know, when people think about who gets what.

What happens if a named beneficiary passes away before Liam?

If a beneficiary named in Liam's will passes away before him, what happens to their intended share depends on the wording of the will and state laws. Sometimes, the will might specify an alternate beneficiary. If not, that share might go to the deceased beneficiary's heirs, or it might fall back into the general estate to be divided among other beneficiaries. It's a bit of a tricky situation, you know, and really highlights the need for clear instructions in a will.

Can Liam's will be contested or challenged?

Yes, a will can be challenged in court, but it's not easy. Someone would need to have a valid legal reason, such as believing Liam was not of sound mind when he made the will, or that he was pressured into signing it, or that the will wasn't properly executed. These challenges can be very difficult to prove and often require substantial evidence. It's a serious matter, you see, to question a will's validity.

Are all of Liam's assets subject to probate?

Not always. Some assets, like those held in a living trust, or accounts with a named beneficiary (such as life insurance policies or retirement accounts), typically pass directly to the named person without going through probate. Jointly owned property with rights of survivorship also avoids probate. It’s a way, you know, to make things simpler for certain assets.

Ensuring Your Legacy: Tips for Estate Planning

Thinking about Liam's estate can inspire us to consider our own future planning. It’s a really important step, you know, to make sure your wishes are clear and that your loved ones are looked after. Here are some practical ideas for anyone thinking about their own legacy.

- Create a Will: This is the most fundamental step. A will spells out exactly who gets your assets and who manages the process. It's your voice, you know, after you're gone.

- Update Your Will Regularly: Life changes, and so should your will. Marriage, divorce, births, deaths, or significant changes in assets mean you should review and update your will. It's a good practice, you see, to keep it current.

- Name Beneficiaries: For accounts like life insurance, retirement funds, and bank accounts, make sure you have named beneficiaries. These assets often pass directly, avoiding probate. It’s a very direct way to give things to people.

- Consider a Trust: For more complex situations, or if you want more control over how your assets are managed over time, a trust might be a good option. They offer flexibility and can sometimes help avoid probate.

- Keep Records Organized: Make sure your important documents, like your will, financial statements, and property deeds, are in a safe, accessible place. Let a trusted person know where these are. It makes things much easier for your family, truly.

- Talk to Your Family: While personal finances can be private, having open conversations with loved ones about your wishes can prevent misunderstandings and disputes later on. It’s a very kind thing to do, you know, to share your plans.

- Seek Professional Guidance: Estate planning can be complex. Working with a legal professional who specializes in estate law can ensure your plan is legally sound and reflects your true intentions. They can help you with all the details, you see.

Planning for your estate is a gift to your family. It provides clarity and peace of mind, knowing that your wishes will be respected and that the process will be as smooth as possible for those you care about. It’s a way to show you care, you know, for the long term.

The Public's Fascination with Wealth and Legacy

There's something about the future of a substantial estate, like Liam's, that really captures public attention. People are naturally curious about wealth, about how it's accumulated, and what happens to it when someone is no longer here. It's a topic that often sparks conversation and speculation, you know, among many.

This interest isn't just about the money itself; it's also about the story behind it. It’s about the person who built the estate, their life's work, and the legacy they leave behind. People often look for lessons or insights into how wealth is managed across generations. It’s a rather deep human interest, really, in how things continue.

Just as some things are designed to last, to become a cherished part of what comes next, an estate's future is also a kind of lasting design. For instance, you know, as one of our best sellers and an exclusive inherit design, this skirt boasts a flattering straight fit and a dark wash finish that pairs seamlessly with any outfit. It's a design meant to endure, to be passed down in a way, just like a well-planned legacy. This idea of something being an "inherit design" – something that carries forward a certain quality or style – applies to estates too. They carry forward a person's financial and personal design for the future.

The way an estate is handled can also reflect on the person who owned it. A well-organized estate plan speaks to foresight and care, while a messy one can lead to complications and stress for those left behind. It’s a final statement, in a way, about how someone managed their affairs. Learn more about estate planning on our site, and for those interested in lasting designs, you might find something special like an exclusive inherit design.

This ongoing fascination with estates like Liam's reminds us that wealth is more than just numbers; it represents choices, relationships, and a lasting impact. It's a very human story, you see, about what we leave behind. You can find more general information about estate planning and legal advice by visiting a reputable legal resource like The American Bar Association's Estate Planning Resources.

Understanding these aspects helps us appreciate the importance of planning, and how a thoughtful approach to one's estate can truly shape the future for those who remain. It's a conversation that continues, you know, for a long time after someone is gone.

Detail Author:

- Name : Oswaldo Goodwin

- Username : torrance50

- Email : ronaldo05@boyle.org

- Birthdate : 2003-12-27

- Address : 701 Friesen Heights West Tremaynemouth, AK 16228

- Phone : (352) 764-7930

- Company : Toy, Nolan and Vandervort

- Job : Numerical Control Machine Tool Operator

- Bio : Aut alias aliquam beatae. Sed assumenda est qui. Commodi laboriosam ratione omnis sint rem. Ullam voluptas et nulla hic dicta quae.

Socials

facebook:

- url : https://facebook.com/nlangworth

- username : nlangworth

- bio : Ut cupiditate et ex velit sint et.

- followers : 5880

- following : 1581

twitter:

- url : https://twitter.com/nlangworth

- username : nlangworth

- bio : Veritatis qui ut sunt modi reiciendis quo. Dignissimos quia sunt alias accusantium. Omnis modi repellendus maxime repellendus nobis et.

- followers : 1511

- following : 1814